February 20, 2020

While private foundations are nonprofit organizations established for charitable purposes, they are not completely tax-exempt. Since the federal taxation rules for private foundations changed beginning in 2020, it is important for private foundations to understand the differences and the implications of those changes.

Most domestic private foundations, though not subject to income taxes, do pay an annual excise tax on their realized net investment income, under Section 4940 of the Internal Revenue Code.

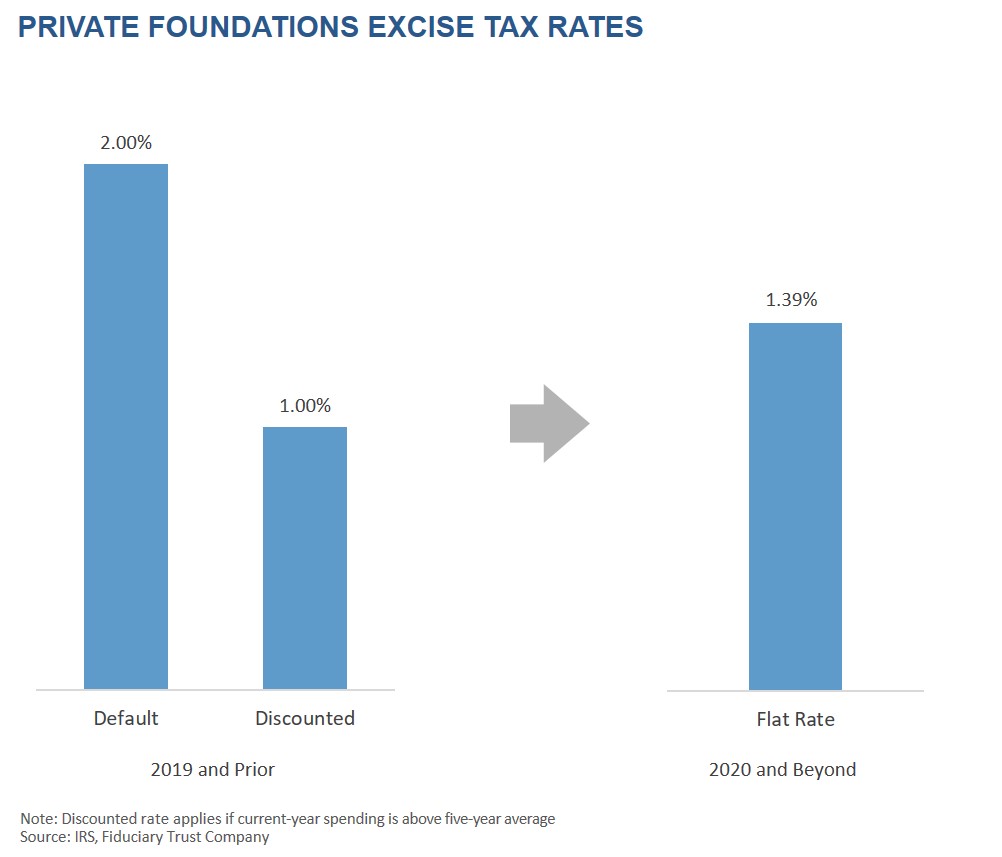

Historically, that excise tax has been applied under a two-tier system:

- A 2% default rate for most net investment income

- A 1% discounted rate based on the amount of the qualifying charitable distributions made in any given year

The actual rate was determined by measuring the private foundation’s current-year distribution amount as a percentage of the foundation’s total assets, and then comparing that figure to the prior five-year average. If the current year’s distribution percentage was greater than the five-year average, the 1% excise tax rate was applied. If not, the private foundation was taxed at the default 2% rate.

Thanks to a new federal law passed at the end of 2019, the rules for the excise tax have been greatly improved.

How the Excise Tax Changed

As part of the federal government’s spending bill (the Further Consolidated Appropriations Act, 2020) and related tax legislation that was signed into law in late 2019, the two-tiered system was replaced by a flat tax rate of 1.39% — the rate deemed to be revenue neutral from the prior system.

The new rate goes into effect for tax years beginning January 1, 2020 and will be used in all cases without regard to specific distribution activity. This should make decision making for private foundations easier, as they no longer have to worry whether grant-making activity in any particular year might shift the foundation’s excise tax rate in current and future years.

It is important to note that while this legislation simplified the tax, it did not change payout requirements. Private foundations that are not private operating foundations must distribute at least 5% of their net investment assets annually in the form of grant-making or eligible administrative expenses. The 5% “payout rule” remains in place, as does the penalty for failure to comply. Private foundations that do not meet the minimum payout rule are subject to a separate excise tax of 30% on undistributed amounts.

Why the Tax Rule Changed

Private foundations serve laudable missions, and trustees who serve on the boards of private foundations play a critical role by making grant-making decisions that align the foundation’s goals and values with real-world needs. As a result, being a trustee can be an enjoyable and rewarding experience.

But at times it can also be burdensome, owing to the administrative obligations of the role. By removing some of the complexity in tax planning, the new single-rate excise tax reduces some of this burden. Moreover, the new methodology is not only easier to understand and forecast, it also allows trustees to focus more of their energy and attention on the grant-making that likely attracted them to the private foundation in the first place.

Under the old two-tier system, private foundations were forced to devote time and resources to monitor how distributions in one year might affect the foundation’s tax liability down the road. This was particularly true in years in which trustees were inclined to make unusually large distributions to meet heightened charitable needs.

For example, private foundations responding to a natural disaster or humanitarian crisis might consider boosting grant-making in a particular year. Despite this being highly aligned with the private foundation’s objective and trustee preference, this might have given trustees pause if knowing that doing so might push the foundation back into the 2% tax rate in the next five years.

The new flat excise tax ensures that trustee charitable grant-making will no longer be influenced by trying to balance near-term grant-making benefits with long-term tax implications.

Final Thoughts

At Fiduciary Trust, we are excited about the new tax law change, as it not only simplifies a complicated system, it also increases focus on — and support of — deserving charitable organizations. Notably, it does so in a manner that is highly aligned with grantor and trustee interests and objectives.

Fiduciary Trust has a long history of supporting charities and helping individuals, endowments, and foundations with their philanthropic efforts. Please contact us if we can be of assistance in helping you plan for and manage your philanthropic investments and giving. You can also learn more about our services here.

Click here to view the pdf version of this article.